how much is virginia inheritance tax

Its only charged on the part of your estate thats above the threshold. It does enforce the rare probate tax though should your estate need to go through that process.

Virginia Estate Tax Everything You Need To Know Smartasset

Property owned jointly between spouses is exempt from inheritance tax.

. Unlike the federal government Virginia does not have an estate tax. Additionally the new higher exemption means that theres room for them to give away another 720000 in 2022. Virginia currently does not have an independent estate tax that is lower than the federal exemption.

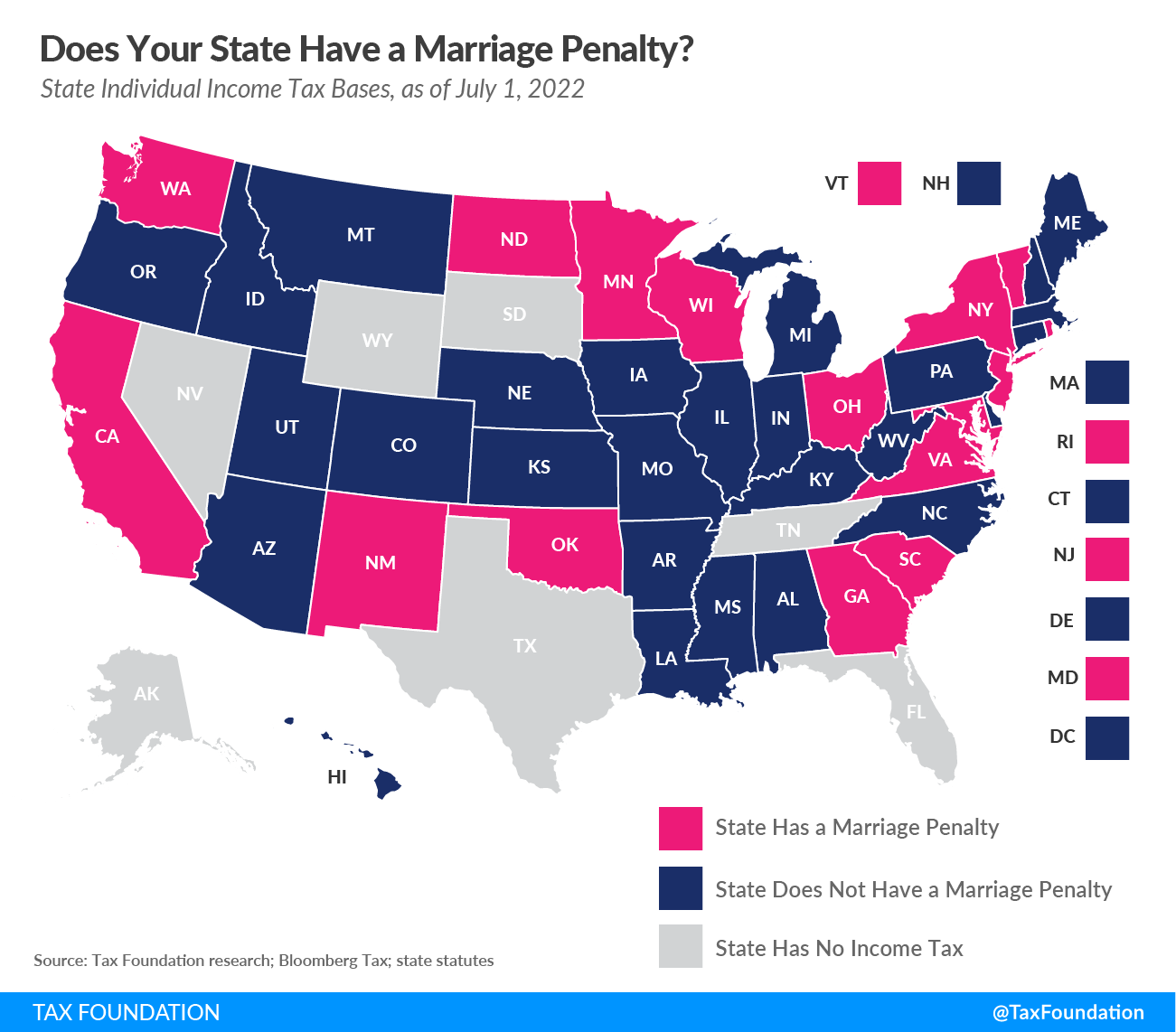

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. Generally Virginia charges a state sales tax of 53. Six states collect a state inheritance tax as of 2021 and one of themMarylandcollects an estate tax as well.

Probate Tax Code of Virginia Sections 581-1711 through 1718 The probate tax is imposed on the probate of most wills and grants of administration and applies to property in Virginia. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. 45 percent on transfers to direct descendants and lineal heirs.

No tax is imposed on estates valued at 15000 or less. States doesnt charge a state inheritance or estate tax. Select Popular Legal Forms Packages of Any Category.

The Inheritance Tax charged will be 40 of 175000 500000 minus. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Whereby this Commonwealth is given reasonable assurance of the collection of its inheritance or death taxes interest and penalties from the estates of decedents dying.

This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. To Answer The Above Attorney No Virginia Does Not Have An Estate Gift Tax. States may also have their own estate tax.

The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure. Virginia Estate Tax 581-900. This is great news for Virginia residents.

If the estate is appraised for up to 1 million more than that threshold the. Virginia like the majority of US. I would be happy to help you manage the tax issues presented by an inheritance.

The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption. How much can you inherit without paying taxes in Virginia. States doesnt charge a state inheritance or estate tax.

15 best ways to avoid inheritance tax in 2020. 15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt from tax. Today Virginia no longer has an estate tax or inheritance tax.

There can be two kinds of death taxes inheritance taxes and estate taxes. As of 2021 only estates worth more than 117 million are taxed and only on the amount that exceeds that number. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level.

Ad Inheritance and Estate Planning Guidance With Simple Pricing. Another states inheritance tax may apply to you if the person leaving you money lived in a state that levies inheritance tax. The federal estate tax exemption is 5450000 for decedents dying in 2016.

The standard Inheritance Tax rate is 40. The tax worth on the house is 188k and we sold it for 200k. All Major Categories Covered.

Any estate worth more than 118 million is subject to estate tax and the amount taken out goes on a sliding scale depending on how much more than 118 million the estate is worth. Based on the value of. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

While other local jurisdictions have an exemption that is lower Virginia does not.

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Virginia Department Of Taxation Linkedin

It May Be Time To Start Worrying About The Estate Tax Published 2021 Estate Tax Capital Gains Tax How To Raise Money

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Virginia Income Tax Calculator Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

West Virginia Virginia West Virginia State Flag

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Where S My Kentucky State Tax Refund Taxact Blog Tax Refund State Tax Kentucky State

West Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

Jobs Research And Development And Investment Tax Credits As Of July 1 2012 Tax Foundation Map State Tax Business Tax

We Buy Houses Cash 855 793 2377 Sell Your House Fast We Buy Houses Virginia 855 793 2377 Sell Your H Sell Your House Fast We Buy Houses Selling Your House